Black Litterman Model Excel Download

PT L20 The Black Litterman Model in Excel Phil Davies. Black-Litterman Model - Duration. Treynor-Black Model: Excel - Duration. Free black litterman spreadsheet downloads - Collection of black litterman spreadsheet freeware, shareware download - Mr. Black Jack, Black Jack, Profit Loss Report.

Hoadley Black-Litterman Returns Estimator Returns Estimation & Asset Allocation Software Overview of the Black-Litterman Model One of the most sophisticated and widely used models for portfolio returns estimation and asset allocation is the Black-Litterman Bayesian asset allocation model. The Black-Litterman model was developed by Fischer Black and Robert Litterman at Goldman Sachs in the early 1990s. The Black-Litterman model is designed to overcome the main weaknesses with Markowitz Mean-Variance optimization: namely that the traditional method of estimating asset returns in isolation both from other assets and from the market as a whole usually leads to portfolios highly concentrated in a few assets -- ie lacking diversification. Asset portfolio weights are very sensitive to even small changes in return estimates and this leads to portfolios which are risky and impractical to implement.

The Starting point for the Black-Litterman model is a portfolio with assets weighted according to their market capitalizations. Reverse optimization is used to back out the returns implied by the market weightings. These e quilibrium expected returns -- the market neutral reference point -- are combined with user 'views' about the absolute or relative performance of selected asset classes/sectors to produce revised ('blended') estimates of returns. Revised estimated returns are then used to produce an optimal portfolio and, if required, an efficient frontier using the. Double Wide Font Download. Using the Black-Litterman model leads to well diversified portfolios which avoid extreme long/short positions, and the wild swings in asset allocation weights which you normally get from MVO when asset returns are changed, even slightly, in isolation. And importantly, the Black-Litterman model achieves this diversification without the need to impose tight arbitrary constraints on asset weights during portfolio optimization.

The Black-Litterman model can be used for asset allocation, where 'assets' are defined in terms of asset classes/sectors/countries etc. Or for individual security selection.

Whilst the principles for both asset allocation and security selection are the same, the Black-Litterman model is usually used for asset allocation using 8-20 asset rather than for allocating weights across a large number of individual securities within a portfolio. The Black-Litterman model is not an alternative to MVO but is complementary to it. Black-Litterman and MVO are usually used together. Using the Hoadley Black-Litterman Returns Estimator The Hoadley Black-Litterman Returns Estimator is an Excel-based software application that can be used by investors to estimate returns and allocate assets using the Black-Litterman model. The interactive nature of the application is designed to facilitate rapid scenario development and prototyping.

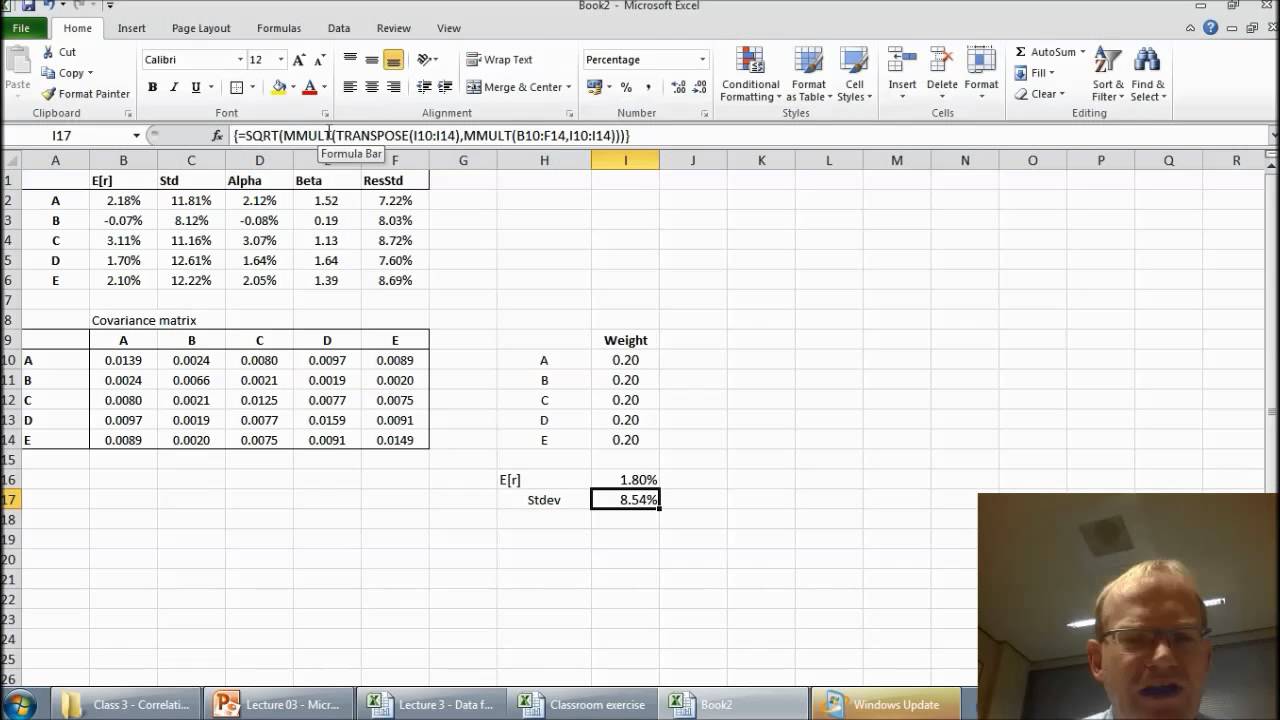

Using the Hoadley Black-Litterman returns estimation software involves three phases: Estimating market equilibrium returns using reverse optimization. The inputs required are estimates of asset market weightings, volatilities and correlations, and an estimate of the overall 'market' risk premium or return. Individual asset returns are then backed out using reverse optimization. Blending equilibrium returns with user views: User views about the absolute or relative returns of individual assets or asset groups are combined with the equilibrium (ie market implied) returns to produce a revised set of 'blended' returns. Calculating optimal portfolio weights: The blended returns are then used to produce the optimal portfolio weights (ie which maximize the Sharpe ratio). Key features of the Hoadley Black-Litterman Returns Estimator include: Flexibility in specifying user views: Views can be specified as absolute (eg 'The return on US bonds will be 4.5% pa (80% confident)' or as relative (eg 'US small caps and US large caps as a group will out-perform equities in international developed markets and emerging markets by 1% (50% confident)'.